About TSCC

Mission Statement

The Tax Supervising and Conservation Commission (TSCC) protects the public interest by ensuring local governments in Multnomah County follow Local Budget Law. We promote efficient use of public money and provide advice to local governments.

TSCC Jurisdiction

The TSCC has authority over 36 of the 43 taxing districts in Multnomah County. Our members include the county’s largest city, school district, community college, and other regional and special districts.

TSCC Commissioners at 2022 TriMet Hearing

What We Do

The TSCC is an independent, impartial panel of community volunteers that monitors the financial affairs of local governments. The Commission is directed by five commissioners who are appointed by the Governor to four-year terms and supported by two full-time staff members.

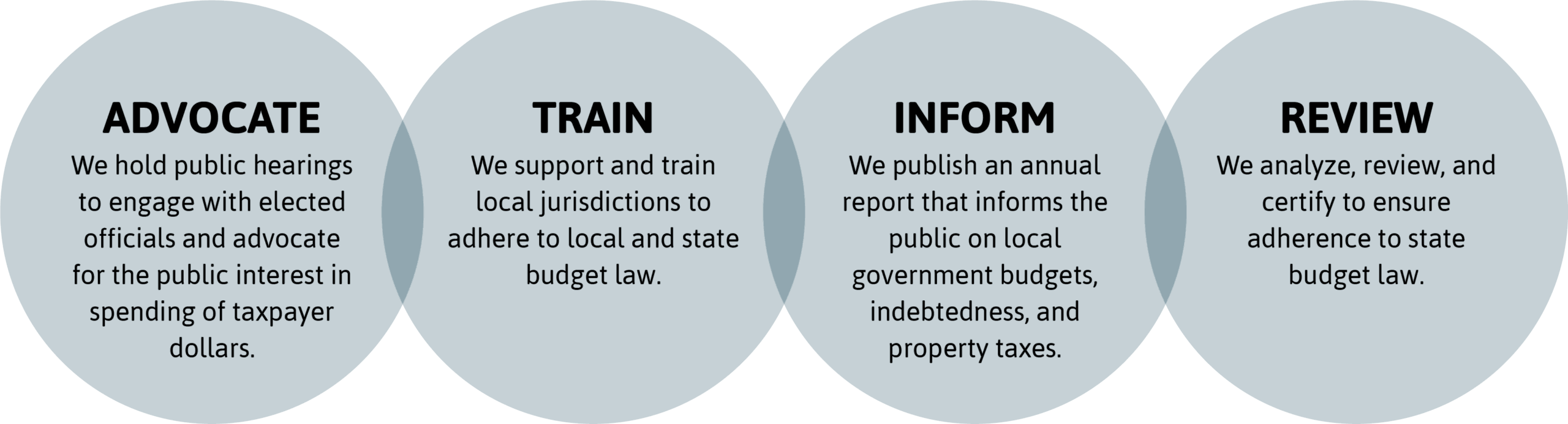

Our main responsibilities include:

Budget Review & Certification

We provide an extensive review of member districts’ budgets, checking for legal compliance and the reasonableness of their estimates. All approved budgets of member taxing must be certificated and may include recommendations or objections in the Commission’s advisory only capacity. All budgets for full TSCC members are reviewed and certified by the Commission before they are adopted. This process distinguishes the TSCC from other regulatory bodies, such as the Oregon Department of Revenue, which do not receive budget documents.

Annual Report & Public Information

By law, we publish a comprehensive Annual Report every year that details the budgets, debt, and property taxes of all local governments in Multnomah County. Copies of this report and other budget documents are available for public review on this website or by contacting us.

Public Hearings

The TSCC provides an independent forum for community members to get information and share their views on budgets. Our commissioners represent the public by asking questions on behalf of the community. We hold annual public hearings for large entities and additional hearings for property tax measures of our member districts.

Trainings

We take a proactive approach to compliance by partnering with local governments throughout the year on training and consulting to tackle budget law questions and puzzles. We hold annual trainings for local government finance staff and consult with our member districts throughout the year. Our training page provides a number of resources for quick refreshers throughout the year.

Funding

Our operating expenses are limited by law to a 4% annual increase and split between Multnomah County and TSCC member districts. All TSCC costs are paid for by Multnomah County’s General Fund. Office space is also provided by the county. The county is then reimbursed for half of these costs by the municipal corporations under the commission’s jurisdiction.