Recruitment for TSCC Commissioners Now Open

Oregon Governor Tina Kotek is recruiting for new Commissioners for the Tax Supervising and Conservation Commission (TSCC). If you are an engaged, curious and thoughtful community member with an interest in local government, this might be the role for you. To learn more, please review the TSCC Commissioner Position Description. TSCC staff are also happy to answer questions.

Applications are accepted anytime on the Governor’s Boards and Commissions Website. Please submit by September 15th, 2025 for consideration.

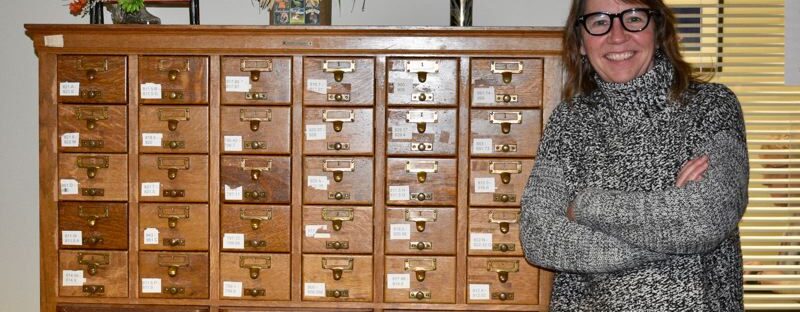

Serving Multnomah County for over 100 Years

The Tax Supervising and Conservation Commission was created by the Oregon Legislature in 1919 as an advisory body to oversee budgets, taxes, debt, and management practices of Multnomah County taxing districts. TSCC is an important resource for member districts and provides support, education, and consulting services to help districts be in compliance with budget law. We review and certify budgets, review property tax measures, and provide information and training for district staff.

TSCC Update Newsletter

The TSCC Update Newsletter is a compendium of recent news and information for and about local governments and school districts in Multnomah County and statewide.

Subscriptions are free and users can easily unsubscribe.

Sign up to receive the TSCC Weekly Update